Sooner or later? The outlook for RBA cash rate increases.

By Jukka Viljanmaa, Senior Investment Manager – TPT Wealth.

The Reserve Bank of Australia Board meeting in July 2021 resulted in no change to the cash rate target as expected. However, there was a slight change to the language used to articulate their expectation of when they expect to first increase the cash rate target from the current all-time low level of 0.10%.

For some time the R.B.A. Board have been signalling that it is unlikely they will increase the cash rate target before 2024.

After the June Board meeting the statement by Reserve Bank of Australia Governor Philip Lowe noted:

“It (R.B.A.) will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. For this to occur, the labour market will need to be tight enough to generate wages growth that is materially higher than it is currently. This is unlikely to be until 2024 at the earliest.”

After the July Board meeting the messaging changed to:

“It (R.B.A.) will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. The Bank’s central scenario for the economy is that this condition will not be met before 2024. Meaning it will require the labour market to be tight enough to generate wages growth that is materially higher than it is currently.”

This is a subtle but significant change in language.

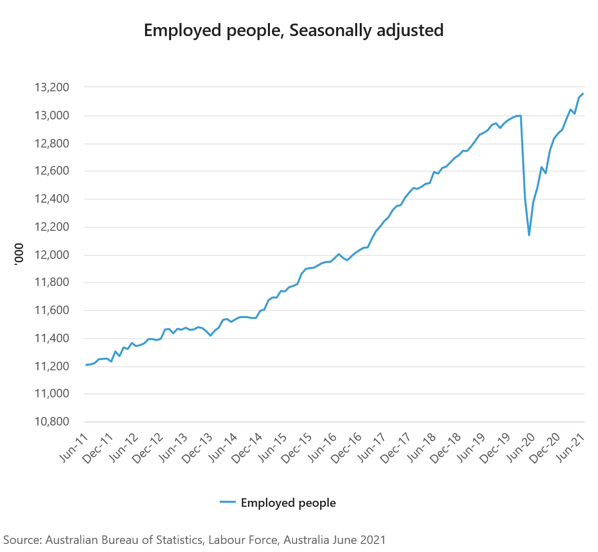

After a series of stronger than expected Labour Force survey numbers estimating employment, the Bank has given itself some optionality around the timing of the first cash rate increase.

The interest rate market reaction to the release of the statement by Dr Lowe, post the July meeting, priced the cash rate target reaching 1.75% by June 2025, while the first 25 basis point increase is priced for September 2022. Whether this happens sooner or later will not only depend on the data but also how events play out during the unusual times we currently live in with Covid-19.

A key condition for the R.B.A. Board to raise the cash rate target requires the labour market to continue to generate employment growth, and it is likely wages growth will need to exceed 3%. The Board believes unemployment must decrease to below 4% to generate this level of wage inflation.

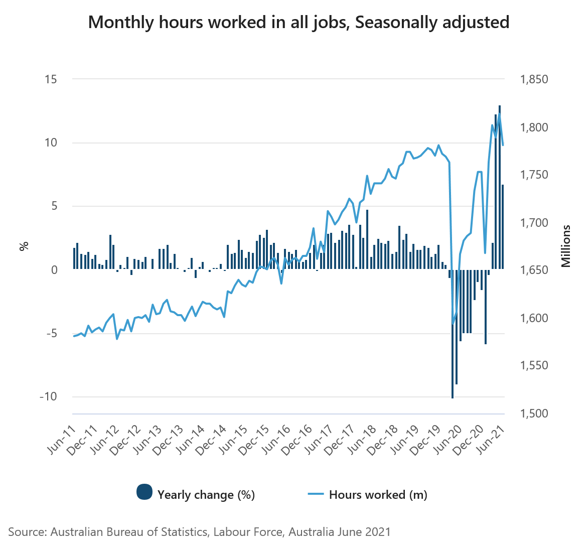

The make-up of the Australian employment market has changed over the last 15 months. Australian resident unemployed people decreased by 303,700 from June 2020 to June 2021, however some 300,000 non-resident visa holders have left Australia due to Covid-19. Australian residents have been employed in their place with borders remaining closed. The R.B.A. are cognisant that when borders reopen there will potentially be an influx of labour. Further, the underemployment rate is 7.9%, representing people who are prepared to work more hours and presumably at the same wage.

To be sure the employment market is exhibiting strength at the moment. The release of the June data indicated the estimate of unemployment was currently 4.90%. In February 2020 the unemployment rate was 5.1% before it spiked up to 7.4%, only 5 months later. Governor Lowe has recognised that over the last 40 years wage growth has only exceeded 3% once, so the hurdle has been set at a high level.

The recurring lockdowns are also impacting employment, with the hours worked metric useful to understand how developments are unfolding.

Historically the R.B.A. would increase the cash rate target when their forecast for inflation was within the 2 to 3 percent band. However in a significant shift they now want to see actual inflation within that band on a sustainable basis. Whilst there is currently strong momentum in economic growth and employment, how events play out – particularly borders reopening – will determine when the R.B.A. increases the cash rate target.

The views and opinions expressed are presented for informational purposes only and are a reflection of the best judgement at the time the content was compiled by the Senior Investment Manager, TPT Wealth.