What’s happening with inflation? Australia vs the world

The events of the past two years have put inflation firmly in the spotlight around the world. But what does it mean for us here in Australia?

Before we get started, here’s a quick refresher on what inflation is and how we measure it.

Put simply, inflation is the general rise of prices of a whole range of factors that make up the economy.

It can be measured as headline inflation or core inflation.

Headline inflation is the total inflation in an economy, including things like food and energy, which can be prone to more volatile spikes than other categories. Core inflation is calculated without these more volatile commodities, and usually yields a more consistent rate.

Before the pandemic, our inflation rates were relatively low and stable, but in the last 12 months headline inflation in Australia has accelerated significantly, prompting us to look around the world to see what this might mean for us in months to come.

Inflation rates overseas

Currently, the US, UK and New Zealand are all experiencing core inflation well above their monetary policy targets.

Why do we think that is?

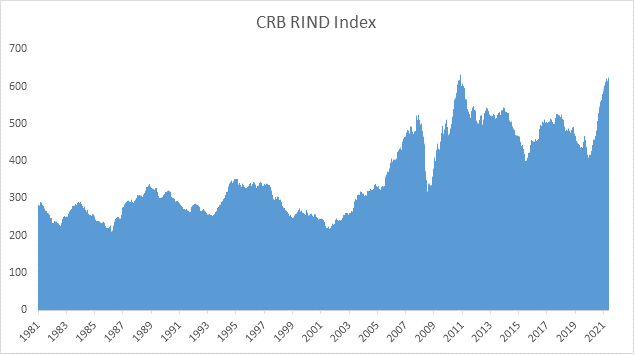

Increases in energy prices, commodity or raw material prices, supply chain constraints, and shipping costs are all contributing to the increase in offshore inflation. The CRB RIND index illustrates that raw material prices are near all-time highs.

Figure 1 Source Bloomberg

When products cost more to make, they cost more to buy, so we’re seeing these increases impact the cost of goods coming out of China. At the same time, supply chains are delaying the delivery of their products and goods, which puts pressure on the system and starts to swell demand.

Lockdowns across the globe have also influenced the way we spend, with the US seeing 26% excess demand for durable goods. Not only has this driven prices up to 11% higher than they were before the pandemic, but the manufacturers just can’t keep up.

So, can we expect to see these surges happening in Australia too?

First, we have to take a look at wages.

Wage growth around the world presents a similar picture to global inflation, with the US and UK wage growth approximately 2% above the long run average.

But it’s not the same story back home. Current wage growth in Australia is around 1.79%, which is why our inflation experience is looking very different to the US and UK. For the RBA to consider lifting the cash rate, we need wage growth to hit 3%, and we’re not quite there yet.

Even with lockdowns ending and economies opening up, we still have many people working reduced hours and an underemployment rate of 9.2%. This means that while businesses might be experiencing a pick-up in economic activity, they’re likely to service this increase in activity with employees looking to increase their hours, meaning we’re unlikely to notice an impact to staff levels and wages in the short term.

Does this mean we’ll still be affected by global inflation?

The short answer is yes. Inflation in the US now appears to be less transitory and more of an issue in the medium term. This comes at a time when investors are becoming less optimistic about global growth, particularly in the US. China is also experiencing a slowdown in official numbers.

And while we’re not seeing wages pressure at the moment, the rising costs of goods and services may motivate consumers to ask for pay increases to keep up.

Markets are currently predicting an increase to the cash rate target of 100 basis points for 2022. Despite all this, the RBA maintains its inflation targets between 2% and 3%, stating there will be no increases to the cash rate target until 2024.

There is certainly a lot to keep an eye on in the coming weeks as we move closer to resuming our pre-pandemic economic activity. At the November RBA Board meeting it was decided to remove the 10 basis point target for the 3 year Government bond and the RBA now sees it “plausible that a lift in the cash rate could be appropriate in 2023”.

One things for sure, all eyes (including ours) will now turn to the RBA each month, looking for any discernible change, however small, to give us a clue about what we can expect next.

The views and opinions expressed are presented for informational purposes only and are a reflection of the best judgement at the time the content was compiled by the Senior Investment Manager, TPT Wealth.